Let’s get you moving

Call usSpring sale

Save up to £10,000 with our used PCO cars on Rent 2 Buy +

Save up to £10,000 with our used PCO cars on Rent 2 Buy +

Join the family

Otto provides more than a car. We are London’s largest community of PCO drivers.

Trusted by

Trusted by

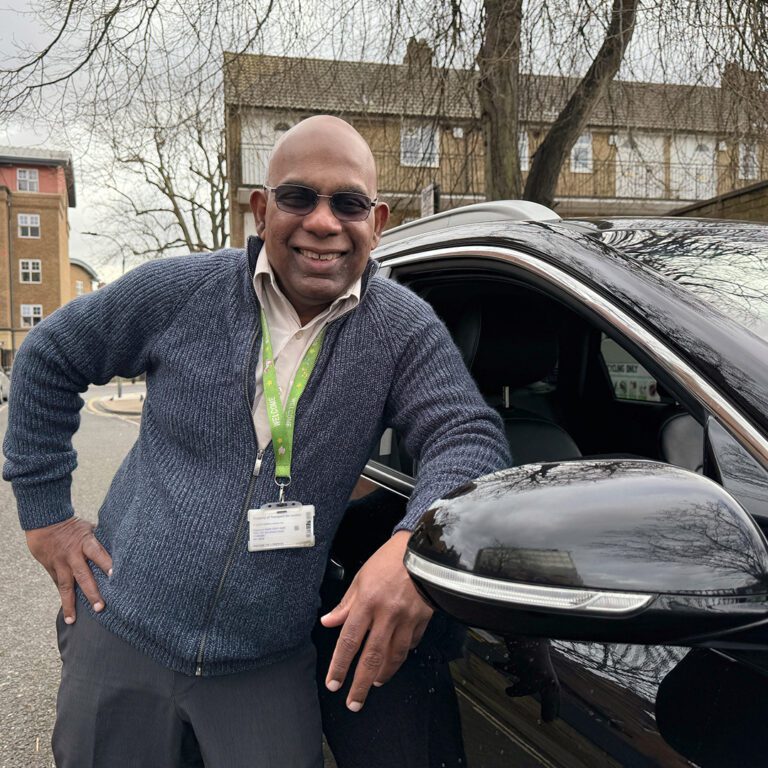

What our customers have to say…

”

Otto Car is everything that a new Uber driver needs to earn a living. No fuss. No hassle”

”

When I go into an Otto hub, it’s always friendly. Feels like talking to my brothers or uncles”

”

You have solved the day-to-day problems of PCO driving. All my headaches are over”

”

You gave me a PCO car when I had no hope of finance. Today, I’ve paid it off and can retire”

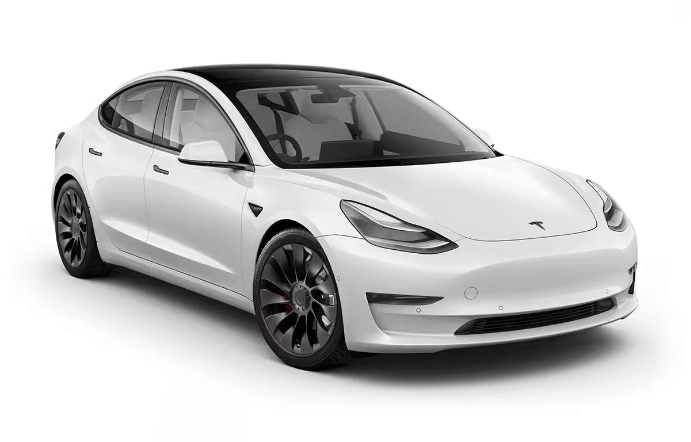

The keys to freedom

Otto Car invented Rent 2 Buy + for Uber Drivers, and is the only PCO car provider to offer 8 weeks of payment breaks per year. We've already helped thousands of people to become car owners since 2015.

Rent 2 Buy + |

Traditional Finance | |

|---|---|---|

| Car ownership plan | ||

| 8 weeks payment breaks per year | ||

| No credit checks | ||

| Insurance & 24/7 breakdown | ||

| Servicing, MOT & PHV licence | ||

| Replacement car* | ||

| Uber Clean Air discount | ||

| Down payment | From £299 | Variable |

Featured PCO Cars

Reasons to believe