FEATURED POST

How to send money abroad from the UK

- The Otto Team

- August 23, 2024

Like many people, PCO drivers often share financial support with their family in other countries.

Making a money transfer to, say, India or Ghana seems a simple idea but there are vital things to know. Some international payments are expensive – and other services don’t protect your funds.

One provider might look cheap but have hidden fees, or risks, which are explained below. To save you time, we’ve also done a spot check on five popular money transfer services.

Let us help you to get as much of your hard-earned Uber money as possible to its destination safely.

This article has not considered your specific circumstances and is not personal advice.

What is the best way to transfer money internationally?

Aside from putting real cash into the post – a terrible idea – there are three main options.

1. A bank

In the UK, only firms with a banking licence can call themselves a ‘bank’. This might feel the obvious solution but banks tend to charge big fees and offer poor exchange rates.

2. Independent money transfer provider

Includes various ‘non-bank’ firms or apps, also known as foreign exchange (FX) providers. Some focus on how to send money abroad (eg Remitly) while others have extra services (eg Revolut).

3. High-street providers

These allow your funds to be paid or collected in cash at venues such as shops. The best-known is Western Union. Transfers can be almost instant, too, but do check the full costs.

Should you use a bank to send money abroad?

Probably not. However, if your own bank has a branch (or a partner bank) in the destination country, it might offer you free or low-cost transfers, with online banking.

Opening a foreign bank-account in your name can reduce fees, especially in countries like India or within the EU. That said, many FX providers also give better deals if both people have an account.

Can PayPal send money internationally?

Yes. If you and the recipient have a PayPal account, the fee is 5% of the sum you send, capped at £2.99. Note that PayPal often has poor exchange rates, so it’s rarely a great move.

Which is the best money transfer service?

Independent FX providers vary in terms of features and costs. But think about reputation and flexibility too. For instance, some let you send international payments as a mobile wallet top-up.

We compared the true cost of sending £1,000 to India via a bank transfer in rupees on 19 Aug 2024.

These firms are all FCA Authorised so your money is protected. (See explanation below).

Revolut | Revolut.com

Same-day transfers with no minimum, plus competitive exchange rates and low fees (or none if your recipient also uses Revolut). These accounts have lots of financial services but the TrustPilot score is only modest. Good for regular small transfers or those who like options.

Trustpilot score: 4.1

Spot check: £1,000 gives ₹108,191 (Inc £1.50 fee)

Wise | Wise.com

Wise uses the ‘real’ (i.e. mid-market) exchange rate and says money arrives in seconds. You can have a debit card or hold multiple currencies in one account. The fee is high and worse if you pay with a non-Wise debit or credit card. Even so, it’s a solid choice due to the attractive rates.

Trustpilot score: 4.3

Spot check: £1,000 gives ₹107,958 (Inc £5.69 fee)

Remitly | Remitly.com

Remitly is based in the US, yet says it helps immigrants all over the world send money to loved ones in other countries. It has a global reach, competitive exchange rates and low fees, albeit these vary a lot, which is complex. The 24/7 customer service seems to please users.

Trustpilot score: 4.5

Spot check: £1,000 gives ₹108,740 (Inc £1.99 fee)

Western Union | Westernunion.com

If you need to make a rapid one-off payment, Western Union’s truly global network is great, as the money can be sent from or received in many locations (i.e. not just banks). The exchange rate is not bad but fees are confusing, especially for cash payment or pickups. No fee on first transfer.

Trustpilot score: 4.2

Spot check: £1,000 gives ₹108,684. (Inc £1.99 fee)

ACE Money Transfer | Acemoneytransfer.com

This niche provider specialises in money transfers and has a strong Trustpilot score. The exchange rate is competitive and there’s no fee for first-time users. ACE Money Transfer restricts the first transfer to £925, so the figure below is an estimate, including its standard £1.99 fee.

Trustpilot score: 4.8

Spot check: £1,000 gives ₹108,231 (Inc £1.99 fee)

What is the cheapest way to send money abroad?

There are three elements to a money transfer. The fee, the exchange rate – and the total received.

1. Money transfer fees

Fees vary between international payment providers. Sometimes it’s a flat fee, while others take a percentage of the amount sent and a few charge none.

If you send £10 and the flat fee is £1 the transfer will cost £1 before the exchange rate is applied.

The fee also depends on how quickly the money arrives, the destination country – and if it’s sent into a bank account or collected in cash.

2. Exchange rates

The exchange rate might affect how much money the recipient will get more than the actual fee. Some FX providers don’t even charge a fee, as they make all their money from the exchange rate.

Rates vary a lot and might change throughout one day, so timing can save you money. Some providers allow you to fix a good rate for a future transfer. This is known as a forward contract.

Check the ‘real’ exchange rate, also called the mid-market rate, either on Google or Wise.com.

3. Total received

The true value of any money transfer is how much currency the friend or family member receives.

Ask one simple question before sending money: “How many dinars or dollars will my recipient get?”

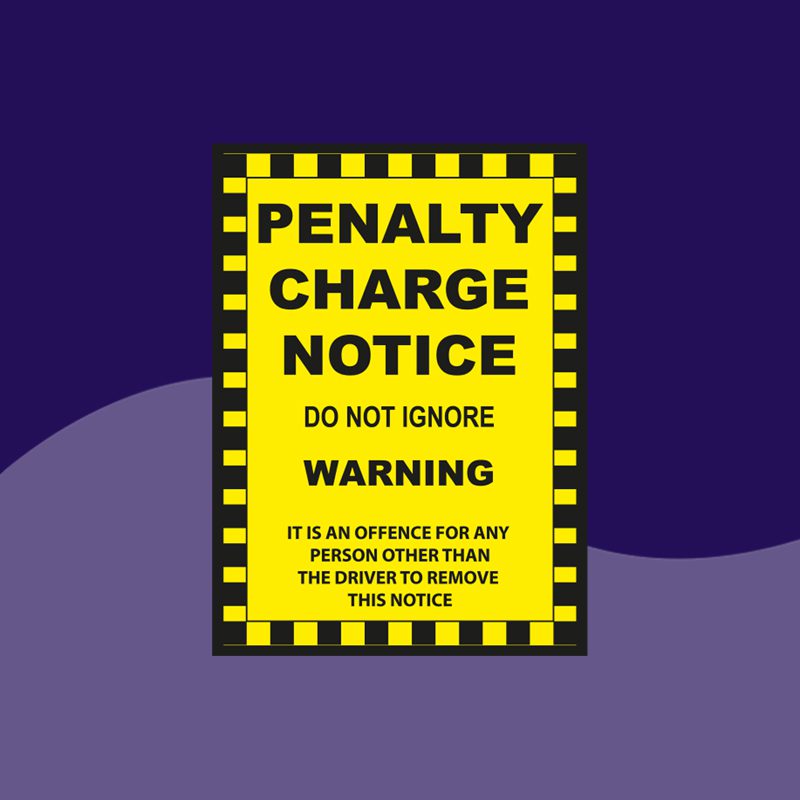

How to send money abroad safely

The crucial thing is that your funds are not lost or stolen. Here’s how to stop it happening.

Choose a provider with protection

Banks in the UK are covered by the Financial Services Compensation Scheme, which completely safeguards your money (up to £85,000) if one fails.

For non-banks, check the firm is ‘FCA Authorised’. This means it’s regulated by the Financial Conduct Authority (FCA) and must protect your money if it goes bust. Your funds will be kept in a separate account or covered by an insurance policy.

Be cautious of firms that are only ‘FCA Registered’ as this lacks the same level of safety.

How to spot scammers

Scammers target people who make international money payments. With AI, it’s getting harder to avoid these but common sense is your friend. Look out for these red flags:

- Urgent money transfer requests due to a ‘family emergency’.

- Phone calls claiming to be from a bank that fish for personal information.

- Social media messages or emails with spelling mistakes or weird links.

- Deals that sound too good to be true. (They probably are).

Final checks on payment information

Always review the details carefully before you press ‘send’. Even a small mistake can delay a transfer, cost you more than planned, or go to the wrong person.

You work hard as a private hire driver and so your savings should arrive safely with the ones you love.

Follow the tips above and everything will hopefully go as smoothly as a midnight airport run.

About Otto Car

Getting started as an Uber driver can feel complex but you are not alone. Otto Car is London’s largest community of private hire drivers. We offer easy access to excellent PCO cars with no credit checks.

Be part of something big. Join the family.

Taking the next step

Whether you prefer a flexible rental or an inclusive ownership plan, we’ve got you. Pop into any of our five London hubs for a chat or say hello on 020 8740 7444.

Want to learn more?

Vestibulum nec scelerisque mauris,eget finibus justo. Vivamus metus justo, semper vel facilisis quis, scelerisque ut libero. Aenean eget porttitor nisi. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum nec scelerisque mauris,eget finibus justo. Aenean eget porttitor nisi. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum nec scelerisque mauris,eget finibus justo. Vivamus metus justo, semper vel facilisis quis, scelerisque ut libero. Aenean eget porttitor nisi. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum nec scelerisque mauris,eget finibus justo. Aenean eget porttitor nisi. Lorem ipsum dolor sit amet, consectetur adipiscing elit.